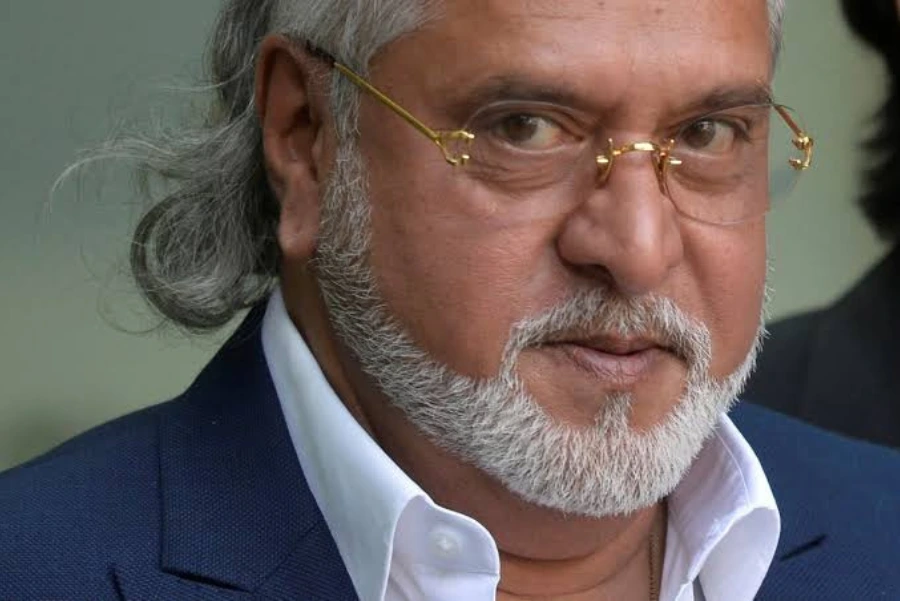

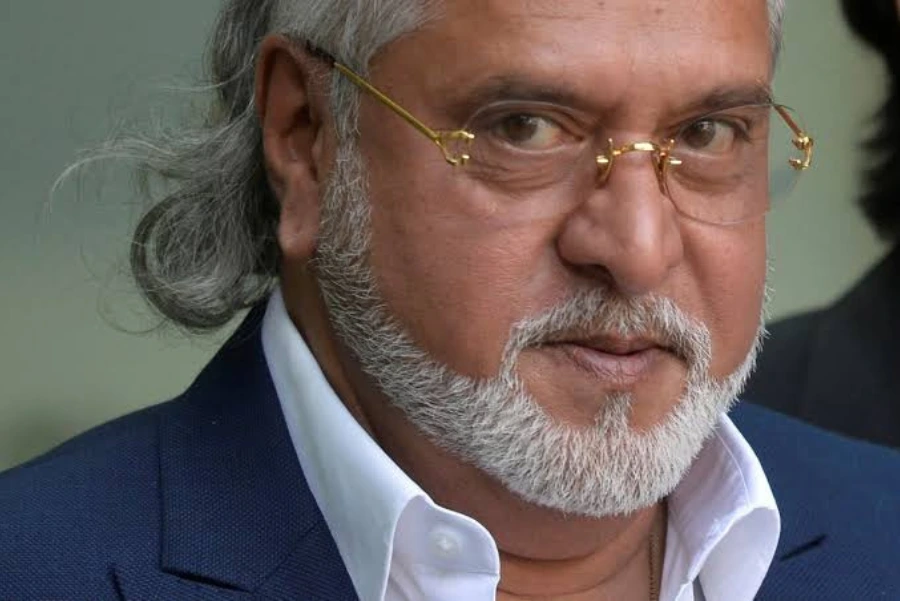

Vijay Mallya Debt Recovery: High Court Seeks Bank Response

Mallya, the fugitive businessman, has lodged a petition in the High Court saying that his debts had been recovered many times, and yet, the recovery litigations are cancelled against him. The banks have been given notice by the court to file their response by February 13.

Debt Recovery Dispute: Mallya’s Position on Legal Proceedings

Lead Counsel Sajan Poovayya for Mallya argued that both the winding-up order for Kingfisher Airlines and that of UBHL (United Breweries Holdings Limited) have been upheld by all courts, including the Supreme Court.

Much stress, however, was laid upon the fact that a Debt Recovery Tribunal (DRT) had ordered Kingfisher Airlines and UBHL to repay ₹6,200 crore but that the total collection had ‘eclipsed’ this amount.

What Is the Sum Recovered?

Matter of Mallya’s lawyers:

- ₹10,200 crore recovery, as assertion is made by the recovery officer

- Official liquidator has expressed that banks had already recovered their payments

- The FM told Parliament that ₹14,000 crore has been recovered

Despite these recoveries, the banks still continued with further recovery actions, causing suspicion over transparency.

Petition Synopsis & Judicial Opinions

1.There Is No Certified Clearance on Full Debt

Mallya’s petition does not contest the original loan repayment but pleads: Because it is a secured debt under the Companies Act, UBHL was released from all obligations by paying off the loan in full. That certification from the recovery officer that this debt has been cleared is yet to be received.

2. Demands for Statements and Asset Disclosures from the Banks

The request states that the banks need to:

- State the overall amount recovered and specify the sources

- Declare whether any assets belonging to Mallya, UBHL, or third parties are still being held by the banks.

3. Request for Temporary Assistance

Mallya’s legal team has moved for an additional temporary halt on the sales of other assets through the revised recovery certificate until the matter is decided.

What follows?

With the court now directing the banks, also to furnish their responses by February 13, this saga remains one of India’s most-discussed and newsworthy items in finance and law. Keep your eyes peeled for recent news updates on the progress.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

For the reason that the admin of this website is working, no hesitation very rapidly it will be famous, due to its quality contents.

Thank you, I have just been searching for info approximately this subject for a long time and yours is the greatest I have came upon so far. But, what in regards to the conclusion? Are you certain in regards to the source?

Great info. Lucky me I discovered your website by chance (stumbleupon). I’ve saved as a favorite for later!

Wow, that’s what I was exploring for, what a material! existing here at this web site, thanks admin of this website.

Wow, that’s what I was looking for, what a information! existing here at this blog, thanks admin of this web site.

Wow, that’s what I was looking for, what a material! existing here at this webpage, thanks admin of this web page.

Wow, that’s what I was searching for, what a data! existing here at this website, thanks admin of this website.

Wow, that’s what I was seeking for, what a material! present here at this webpage, thanks admin of this website.

Wow, that’s what I was exploring for, what a stuff! present here at this weblog, thanks admin of this web page.

Hurrah, that’s what I was searching for, what a material! existing here at this webpage, thanks admin of this website.

Wow, that’s what I was seeking for, what a stuff! existing here at this website, thanks admin of this web page.

Wow, that’s what I was exploring for, what a material! present here at this webpage, thanks admin of this website.

Wow, that’s what I was seeking for, what a data! present here at this blog, thanks admin of this website.

Hurrah, that’s what I was looking for, what a stuff! existing here at this webpage, thanks admin of this site.

Hi, its good article regarding media print, we all

be aware of media is a fantastic source of data.

After I originally commented I seem to have clicked on the -Notify me when new comments are added- checkbox and now every time a comment is added I get 4 emails with the exact same comment. There has to be a means you are able to remove me from that service? Many thanks!

Hi to every one, it’s actually a fastidious for me to pay a visit this

site, it contains precious Information.

When I initially commented I appear to have clicked on the -Notify me when new comments are added- checkbox and now each time a comment is added I recieve four emails with the exact same comment. Perhaps there is a means you can remove me from that service? Cheers!

When I initially commented I seem to have clicked on the -Notify me when new comments are added- checkbox and from now on every time a comment is added I recieve four emails with the exact same comment. There has to be a way you are able to remove me from that service? Appreciate it!

After I initially commented I appear to have clicked on the -Notify me when new comments are added- checkbox and from now on every time a comment is added I receive four emails with the exact same comment. Perhaps there is a way you are able to remove me from that service? Thanks!

When I initially left a comment I seem to have clicked on the -Notify me when new comments are added- checkbox and from now on each time a comment is added I recieve four emails with the exact same comment. Perhaps there is a way you are able to remove me from that service? Many thanks!

When I originally commented I appear to have clicked the -Notify me when new comments are added- checkbox and now whenever a comment is added I recieve 4 emails with the exact same comment. Perhaps there is a way you are able to remove me from that service? Thank you!

When I originally commented I seem to have clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I recieve four emails with the same comment. There has to be an easy method you can remove me from that service? Many thanks!

When I originally commented I seem to have clicked the -Notify me when new comments are added- checkbox and now every time a comment is added I receive four emails with the same comment. There has to be a way you are able to remove me from that service? Cheers!

Hey there! I could have sworn I’ve been to this blog before but after checking through some of the post I realized it’s new to me. Nonetheless, I’m definitely delighted I found it and I’ll be bookmarking and checking back often!

Hey! I could have sworn I’ve been to this blog before but after browsing through some of the post I realized it’s new to me. Anyways, I’m definitely delighted I found it and I’ll be book-marking and checking back often!

Hey! I could have sworn I’ve been to this blog before but after reading through some of the post I realized it’s new to me. Anyways, I’m definitely glad I found it and I’ll be book-marking and checking back often!

Good day! I could have sworn I’ve been to this site before but after reading through some of the post I realized it’s new to me. Anyways, I’m definitely glad I found it and I’ll be bookmarking and checking back often!

Howdy! I could have sworn I’ve been to this blog before but after checking through some of the post I realized it’s new to me. Anyways, I’m definitely glad I found it and I’ll be book-marking and checking back often!

Hello there! I could have sworn I’ve been to this blog before but after browsing through some of the post I realized it’s new to me. Anyways, I’m definitely glad I found it and I’ll be bookmarking and checking back often!

Hi! I could have sworn I’ve been to this blog before but after checking through some of the post I realized it’s new to me. Anyhow, I’m definitely delighted I found it and I’ll be book-marking and checking back frequently!

Hi! I could have sworn I’ve been to this site before but after checking through some of the post I realized it’s new to me. Nonetheless, I’m definitely glad I found it and I’ll be book-marking and checking back frequently!

Hi! I could have sworn I’ve been to this blog before but after browsing through some of the post I realized it’s new to me. Anyhow, I’m definitely delighted I found it and I’ll be bookmarking and checking back often!

Hey there! I could have sworn I’ve been to this blog before but after reading through some of the post I realized it’s new to me. Anyways, I’m definitely glad I found it and I’ll be bookmarking and checking back frequently!

This site was… how do I say it? Relevant!! Finally I have found something which helped me. Appreciate it!

whoah this weblog is excellent i love studying your articles. Keep up the great work! You recognize, many people are looking round for this information, you can aid them greatly.

We are a gaggle of volunteers and starting a new scheme in our community. Your web site provided us with valuable info to work on. You have done an impressive task and our whole group might be thankful to you.

Hi, I would like to subscribe for this blog to get most up-to-date updates, so where can i do it please assist.

Really no matter if someone doesn’t be aware of afterward its up to other viewers that they will help, so here it happens.

Great goods from you, man. I have understand your stuff previous to and you’re just too great. I actually like what you’ve acquired here, certainly like what you are saying and the way in which you say it. You make it enjoyable and you still take care of to keep it sensible. I can not wait to read far more from you. This is actually a tremendous site.

Wow! This blog looks just like my old one! It’s on a completely different topic but it has pretty much the same page layout and design. Excellent choice of colors!

I was wondering if you ever considered changing the structure of your website? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having one or two pictures. Maybe you could space it out better?

Great blog! Do you have any hints for aspiring writers? I’m planning to start my own website soon but I’m a little lost on everything. Would you recommend starting with a free platform like WordPress or go for a paid option? There are so many options out there that I’m completely overwhelmed .. Any ideas? Many thanks!

Wonderful post! We are linking to this great article on our website. Keep up the good writing.

At this time I am going to do my breakfast, after having my breakfast coming yet again to read more news.

You could certainly see your enthusiasm in the article you write. The sector hopes for even more passionate writers such as you who are not afraid to mention how they believe. Always follow your heart.

Great delivery. Solid arguments. Keep up the amazing effort.

Hello there, just became alert to your blog through Google, and found that it is really informative. I’m going to watch out for brussels. I will appreciate if you continue this in future. Many people will be benefited from your writing. Cheers!

My brother suggested I might like this web site. He was totally right. This post actually made my day. You can not imagine just how much time I had spent for this information! Thanks!

I’m not sure exactly why but this web site is loading extremely slow for me. Is anyone else having this problem or is it a problem on my end? I’ll check back later on and see if the problem still exists.

I constantly spent my half an hour to read this website’s articles or reviews daily along with a mug of coffee.

I am regular visitor, how are you everybody? This piece of writing posted at this web page is in fact pleasant.

What i don’t understood is in truth how you are now not really much more well-liked than you might be now. You’re very intelligent. You understand thus significantly in the case of this matter, made me in my opinion consider it from so many numerous angles. Its like men and women don’t seem to be interested except it is one thing to accomplish with Lady gaga! Your own stuffs nice. All the time maintain it up!

Keep on writing, great job!

This is very attention-grabbing, You’re a very skilled blogger. I have joined your feed and stay up for in quest of more of your excellent post. Additionally, I’ve shared your site in my social networks

My brother recommended I may like this web site. He was totally right. This publish truly made my day. You can not imagine just how so much time I had spent for this information! Thank you!

With havin so much content and articles do you ever run into any problems of plagorism or copyright infringement? My site has a lot of exclusive content I’ve either created myself or outsourced but it seems a lot of it is popping it up all over the internet without my agreement. Do you know any ways to help protect against content from being ripped off? I’d definitely appreciate it.

Hello! I know this is kinda off topic however , I’d figured I’d ask. Would you be interested in exchanging links or maybe guest authoring a blog article or vice-versa? My blog covers a lot of the same topics as yours and I think we could greatly benefit from each other. If you happen to be interested feel free to shoot me an email. I look forward to hearing from you! Great blog by the way!

Hi, its pleasant piece of writing on the topic of media print, we all understand media is a wonderful source of information.

Way cool! Some extremely valid points! I appreciate you writing this article and also the rest of the site is extremely good.

Hi there! I’m at work surfing around your blog from my new iphone! Just wanted to say I love reading through your blog and look forward to all your posts! Carry on the great work!

I really like what you guys are up too. This kind of clever work and coverage! Keep up the very good works guys I’ve incorporated you guys to my blogroll.

I used to be able to find good advice from your blog articles.

There’s certainly a great deal to find out about this issue. I like all of the points you made.

Hi there, its nice piece of writing about media print, we all be aware of media is a enormous source of data.

Usually I do not learn post on blogs, however I wish to say that this write-up very pressured me to try and do it! Your writing style has been amazed me. Thanks, quite great article.

What’s up every one, here every one is sharing such knowledge, so it’s pleasant to read this weblog, and I used to pay a visit this website everyday.

Hi, i read your blog from time to time and i own a similar one and i was just wondering if you get a lot of spam comments? If so how do you reduce it, any plugin or anything you can recommend? I get so much lately it’s driving me crazy so any support is very much appreciated.

This text is priceless. When can I find out more?

If some one desires to be updated with hottest technologies after that he must be visit this web site and be up to date everyday.

Quality posts is the secret to invite the visitors to pay a visit the web page, that’s what this web site is providing.

Wonderful article! This is the type of info that should be shared across the net. Disgrace on the seek engines for not positioning this put up higher! Come on over and talk over with my site . Thank you =)

I really like what you guys are usually up too. This kind of clever work and coverage! Keep up the awesome works guys I’ve added you guys to my blogroll.

I read this post fully regarding the difference of most up-to-date and earlier technologies, it’s remarkable article.

I am actually glad to read this web site posts which consists of plenty of useful information, thanks for providing these data.

It’s remarkable to pay a visit this site and reading the views of all mates on the topic of this piece of writing, while I am also keen of getting knowledge.

Wow, this paragraph is fastidious, my sister is analyzing these things, so I am going to let know her.

Amazing! Its actually remarkable piece of writing, I have got much clear idea concerning from this paragraph.

Awesome! Its truly awesome piece of writing, I have got

much clear idea regarding from this piece of writing.

Hey There. I discovered your blog using msn. That is a very well

written article. I will make sure to bookmark it and return to

learn extra of your helpful information. Thank

you for the post. I will certainly return.

I could not resist commenting. Exceptionally well written!

Excellent way of describing, and good article to take facts on the topic of my presentation subject, which i am going to convey in institution of higher education.

國產 av – https://kanav.so

I have been browsing online more than three hours today, yet I never found any interesting article like yours. It’s pretty worth enough for me. In my opinion, if all website owners and bloggers made good content as you did, the internet will be a lot more useful than ever before.

My brother recommended I might like this website. He used to be totally right. This post actually made my day. You cann’t imagine just how a lot time I had spent for this information! Thank you!

Wow, that’s what I was seeking for, what a material! existing here at this website, thanks admin of this web site.

I like what you guys tend to be up too. Such clever work and reporting! Keep up the superb works guys I’ve added you guys to blogroll.

It is actually a nice and useful piece of info. I am glad that you shared this helpful info with us. Please stay us up to date like this. Thank you for sharing.

Heya i am for the first time here. I found this board and I find It really useful & it helped me out a lot. I’m hoping to provide something back and help others such as you aided me.

Hi, Neat post. There is an issue with your web site in web explorer, may test this? IE still is the marketplace leader and a good component to folks will omit your magnificent writing due to this problem.

Appreciation to my father who told me regarding this webpage, this blog is actually amazing.

Hey there just wanted to give you a quick heads up and let you know a few of the pictures aren’t loading properly. I’m not sure why but I think its a linking issue. I’ve tried it in two different web browsers and both show the same outcome.

I know this web site offers quality dependent articles and additional stuff, is there any other website which gives these kinds of data in quality?

I used to be recommended this web site via my cousin. I’m now not positive whether this post is written by means of him as no one else understand such certain approximately my trouble. You’re amazing! Thanks!

Hi there, just became alert to your blog through Google, and found that it is truly informative. I’m going to watch out for brussels. I will appreciate if you continue this in future. Many people will be benefited from your writing. Cheers!

Quality posts is the secret to attract the visitors to pay a quick visit the web site, that’s what this web page is providing.

Hi there exceptional website! Does running a blog similar to this take a massive amount work? I have very little knowledge of computer programming but I had been hoping to start my own blog soon. Anyhow, should you have any suggestions or techniques for new blog owners please share. I understand this is off topic however I simply needed to ask. Appreciate it!

Hi there! Do you know if they make any plugins to safeguard against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any tips?