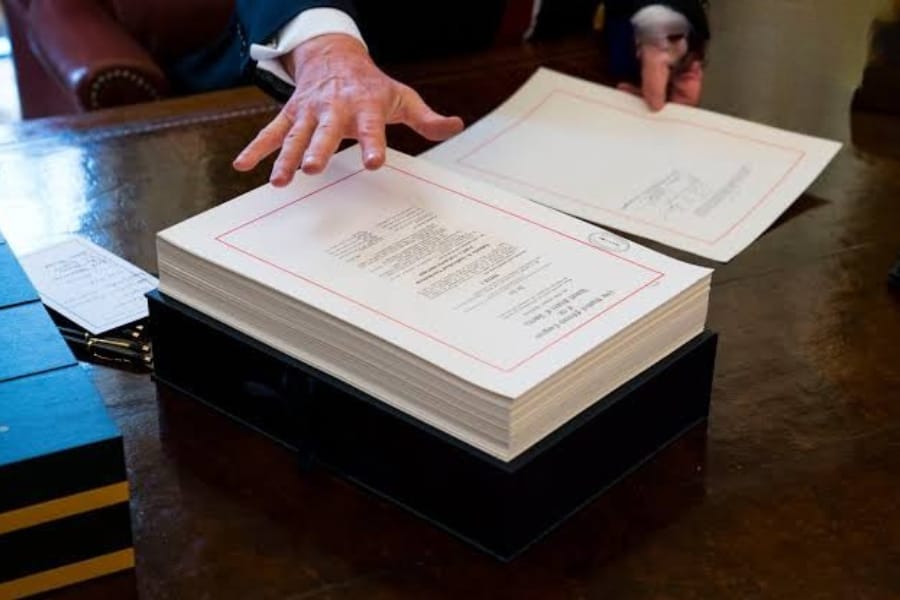

In a significant update, the One Big Beautiful Bill Act has gone through both branches of Congress. It is awaiting an endorsement from former President Donald Trump before it can be put into law. The bill was passed in the House by a razor-thin margin of 218-214. This is pushed along by the efforts of Vice President JD Vance in the Senate. It makes sweeping changes to Medicaid, healthcare, car loan interest deductions, salt caps, and others. Know the policy changes currently affecting the American family.

Big Medicaid Changes

The most significant controversy is the massive $698 billion cut to funding for Medicaid within the next ten years. Able bodied individuals aged 19 to 55 must complete at least 80 hours of work a month to stay eligible. This is stated under the provisions starting December 31, 2026. The regulations will include stricter requirements for income and verification of assets.

The Congressional Budget Office (CBO) estimates that by 2034. Between 8.6 and 11.8 million people will lose their Medicaid coverage. Many of those people live in the most politically important swing districts. It is intended to cut public spending in the long run by making cuts to Medicaid expansion. However it has sparked concerns from healthcare advocates.

Debiting Car Loan Interest: A Win for the Middle Class?

In an eleventh-hour change to the legislation, a deduction for car loan interest will be available to taxpayers beginning January 1, 2025. Persons earning less than $150,000 a year may deduct the first $2,500 of the interest paid each calendar year for an automobile purchased after December 31, 2024. The deduction for auto loan interest applies only to non-commercial and non-luxury vehicles ( $75,000 or less). It means that owners of luxury vehicles will not get a deduction for taxes.

Healthcare Funding: Cuts and Compensation

Furthermore, in order to offset the backlash from the cuts to Medicaid, the legislation sets aside a $50 billion fund to help rural hospitals to be established in 2026.

The provision was added after negotiations led by senator Lisa Murkowski. It is designed to cushion the blow for safety net healthcare facilities. This serves vulnerable low-income and isolated communities.

End to Green Energy Incentives

The legislation also cuts tax credits for green energy. Also, tax incentives for electric vehicles and renewable energy projects (solar and wind) will terminate 60 days after being signed into law. This is set for early September 2025. There is a special allowance for nuclear energy projects already under construction by 2028, showing a shift towards traditional energy policy.

Residential Tax Code Revisions: Reductions, Deductions, and Trump Accounts

At the center of the act is the permanent extension of the 2017 Tax Cuts and Jobs Act (TCJA). This has a cost of $4.5 trillion over ten years. The primary revisions are as follows:

- No taxes on tips and overtime: Beginning on January 1, 2025, tips (up to $25,000) and overtime pay (up to $160,000) that are not taxed for someone with an income below $150,000.

- Child tax credit: Increased to $2,500 for each child starting in 2025 but ending in 2028.

- Trump Accounts: Unique program providing $1,000 deposits for each newborn starting in 2025 through 2028.

Therefore, these provisions attempt to expand disposable income and help working families, primarily those in the service sector.

SALT deduction limit raised for a short period

The limitation on the State and Local Tax (SALT) deduction—a political hot potato for high tax states—will be raised from $10,000 to $40,000 for people earning up to $500,000. Moreover, the limit increases now, upon the act’s signing, but reverts back to $10,000 after five years, in 2030.

Political and Economic implications

Although the act passed along party lines, two Republicans sided with the Democrats out of concerns for the long term effects on finances.

The law’s combination of tax cuts, budget funding cuts, and focused assistance reflects a bold populist move by the Trump administration.

Therefore, business circles will be monitoring the latest news on Business to assess how these reforms affect consumer behavior, the availability of healthcare, and the finances of the states. Especially in an election year.

The Big Beautiful Bill Act will introduce transformative changes for millions of Americans that will alter how they obtain healthcare, purchase cars, and process their taxes. Hence, the law represents a large departure from the political changes in 2025 in terms of significant reforms and significant controversies.

iz5sez

What a information of un-ambiguity and preserveness of valuable familiarity about unpredicted emotions.