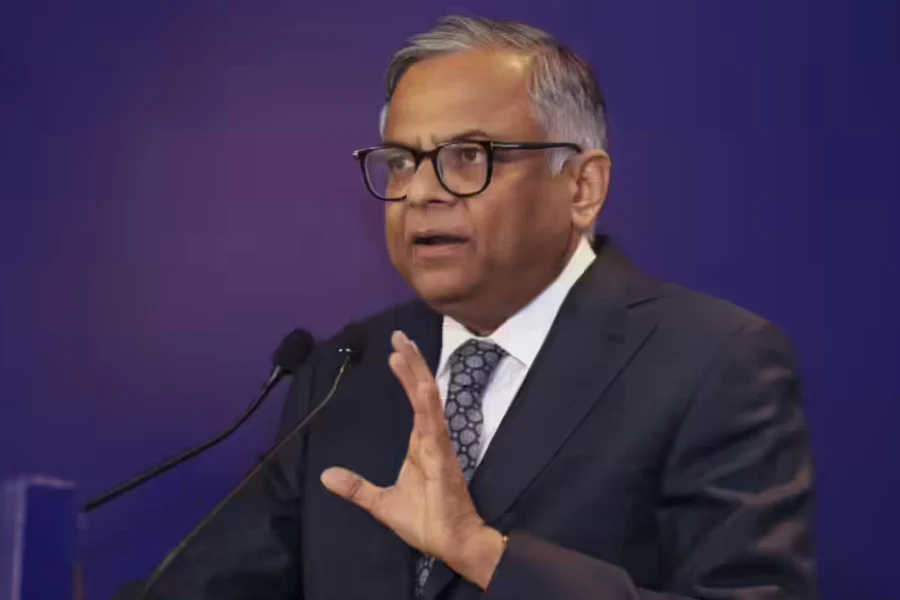

Tata Sons Chairman Extension: In an unprecedented determination, Tata Trusts has approved a third executive term for N Chandrasekaran, Chairman of Tata Sons. It marked the first time the group will keep an executive past 65-year-old retirement age. This decision serves to validate the Tata Group’s trust in Chandrasekaran’s leadership. It also represents level of stability that is needed in a substantially changing group in semiconductors, electric vehicles, and aviation.

A Stability in Leadership

Absent conditioning, the Tata Group’s longstanding policy is to retire executives from active duty by 65. It only permits to hold non-executive positions until 70 years old. Chandrasekaran turns 65 in February 2027. He will not only pass that age but extend it, which is a historic decision for the Group.

The motivation of this decision is the need for stability while Tata engages simultaneously in multiple vital initiatives. These include initiatives such as semiconductor manufacturing, electric vehicle battery manufacturing, and the continued overhaul of Air India. Chandrasekaran’s deeply informed knowledge inside these initiatives. He established track record as a leader. It seemed to the Board to be the right decision how to lead the group out of this complex, multi- faceted and high stakes time.

Navigating a Complicated Phase

The decision comes at a pivotal time for Tata Sons. It is an organization that is facing challenges on multiple fronts, both internally and externally. The issue has emerged within Tata Trusts regarding who should govern the holding company. Whether the group will continue as a privately held company, which adds complexity to governance in the overall group. In this case, extending Chandrasekaran’s position is seen as an exercise in stability by preserving uniformity at the top tier while continuing with structural change.

Industry professionals believe the decision, while unconventional, is reasonable. Tata is one of India’s highest regarded business organizations. It has continuously faces increased challenges of global economic volatility, increased competition, and evolving discussions related to its internal structure. Having a seasoned leader in the role, whose thinking is adaptable, is seen as important in the course of navigating multiple challenges.

Brave Investments: Semiconductors, Electric Vehicles, and Aviation

Leading India’s Semiconductor Industry

Chandrasekaran has led Tata to invest in the advanced semiconductor industry through Tata Electronics. The focus is on reducing India’s dependency on imported chips. This will be by developing a complete ecosystem for semiconductor manufacturing, packaging, and testing. This initiative supports India’s own national interest in becoming a global hub for electronics and digital manufacturing.

Accelerating the EV Revolution

In India’s electric vehicle industry, Tata Motors and its subsidiaries are becoming the pioneers. The group’s progressive investments in battery gigafactories in the UK and India indicate that it is committed to creating a sustainable vertical-integrated EV ecosystem — end-to-end from production to energy storage.

Reviving Air India’s Glory

A significant achievement under Chandrasekaran’s leadership has been Air India’s turnaround. After almost seventy years, the Tata Group regained ownership of the airline after merging Vistara and AirAsia India. The merger aims to establish Air India as a significant international carrier. It will return it to its previous glory while extending India’s aviation sector.

Financial results of Tata Group during Chandrasekaran’s Region

Since Chandrasekaran took over in 2017, the Tata Group has enjoyed significant growth. Over the last five years, the group has almost double its revenue and more than triple its net profit and its market value. Group revenue from all public and private entities amount to ₹15.34 Lakh Crore in FY25 with a net profit of ₹1.13 Lakh Crore.

Tata Sons has improved its overall value from ₹43,252 crore as of 2018 to ₹1.49 lakh crore today. Nevertheless, challenges persist — the group’s overall value diminished downward by approximately ₹6.9 lakh crore over recent months, primarily due to a collapse in the Tata Consultancy Services stock price.

However, the group continues to make strides in fast-growing verticals such as defense, digital commerce, and renewable energy. Mr. Chandrasekaran has been introducing key projects, which include Tata Neu, BigBasket, Croma, Tata 1mg, and Tata Cliq, that is evolving the conglomerate into a tech-focused enterprise.

Chandrasekaran getting a third term signifies action beyond simply ignoring precedent — it underlines Tata’s focus on sustaining growth and innovation. His leadership has brought stability, foresight, and contemporary management practice into global benchmarks.

In terms of new investments in semiconductors, electric vehicles, and aviation, meaning this third term under Chandrasekaran is set to shape the group’s next stage of evolution. The extension of his leadership will hopefully not only focus on enhancing Tata as a market leader, but also on transforming India’s industrial and technology landscape.

For those of us following the veritable latest news on business, this is a demonstration of how traditional conglomerates are repurposing leadership norms to address contemporary goals, wherein it is significant to balance continuity, innovation, and vision.

**mind vault**

mind vault is a premium cognitive support formula created for adults 45+. It’s thoughtfully designed to help maintain clear thinking

**mindvault**

mindvault is a premium cognitive support formula created for adults 45+. It’s thoughtfully designed to help maintain clear thinking

**prostadine**

prostadine is a next-generation prostate support formula designed to help maintain, restore, and enhance optimal male prostate performance.

**sugarmute**

sugarmute is a science-guided nutritional supplement created to help maintain balanced blood sugar while supporting steady energy and mental clarity.

**gl pro**

gl pro is a natural dietary supplement designed to promote balanced blood sugar levels and curb sugar cravings.

**zencortex**

zencortex contains only the natural ingredients that are effective in supporting incredible hearing naturally.

**mitolyn**

mitolyn a nature-inspired supplement crafted to elevate metabolic activity and support sustainable weight management.

**yu sleep**

yusleep is a gentle, nano-enhanced nightly blend designed to help you drift off quickly, stay asleep longer, and wake feeling clear.

**prodentim**

prodentim an advanced probiotic formulation designed to support exceptional oral hygiene while fortifying teeth and gums.

**synaptigen**

synaptigen is a next-generation brain support supplement that blends natural nootropics, adaptogens

**vittaburn**

vittaburn is a liquid dietary supplement formulated to support healthy weight reduction by increasing metabolic rate, reducing hunger, and promoting fat loss.

**nitric boost**

nitric boost is a dietary formula crafted to enhance vitality and promote overall well-being.

**glucore**

glucore is a nutritional supplement that is given to patients daily to assist in maintaining healthy blood sugar and metabolic rates.

**wildgut**

wildgutis a precision-crafted nutritional blend designed to nurture your dog’s digestive tract.

**pineal xt**

pinealxt is a revolutionary supplement that promotes proper pineal gland function and energy levels to support healthy body function.

**energeia**

energeia is the first and only recipe that targets the root cause of stubborn belly fat and Deadly visceral fat.

**boostaro**

boostaro is a specially crafted dietary supplement for men who want to elevate their overall health and vitality.

**prostabliss**

prostabliss is a carefully developed dietary formula aimed at nurturing prostate vitality and improving urinary comfort.

**potent stream**

potent stream is engineered to promote prostate well-being by counteracting the residue that can build up from hard-water minerals within the urinary tract.

**breathe**

breathe is a plant-powered tincture crafted to promote lung performance and enhance your breathing quality.

**hepato burn**

hepato burn is a premium nutritional formula designed to enhance liver function, boost metabolism, and support natural fat breakdown.

**hepato burn**

hepato burn is a potent, plant-based formula created to promote optimal liver performance and naturally stimulate fat-burning mechanisms.

**cellufend**

cellufend is a natural supplement developed to support balanced blood sugar levels through a blend of botanical extracts and essential nutrients.

**prodentim**

prodentim is a forward-thinking oral wellness blend crafted to nurture and maintain a balanced mouth microbiome.

**neurogenica**

neurogenica is a dietary supplement formulated to support nerve health and ease discomfort associated with neuropathy.

**flow force max**

flow force max delivers a forward-thinking, plant-focused way to support prostate health—while also helping maintain everyday energy, libido, and overall vitality.

**revitag**

revitag is a daily skin-support formula created to promote a healthy complexion and visibly diminish the appearance of skin tags.

**sleeplean**

sleeplean is a US-trusted, naturally focused nighttime support formula that helps your body burn fat while you rest.

Very interesting topic, regards for posting.

Thanks a lot for sharing this with all of us you actually know what you are talking about! Bookmarked. Kindly also visit my site =). We could have a link exchange agreement between us!

I must convey my admiration for your generosity for individuals that should have help on that area of interest. Your very own dedication to passing the message along had become certainly helpful and has constantly permitted most people much like me to reach their targets. Your personal warm and friendly facts indicates a lot a person like me and extremely more to my peers. Thanks a ton; from each one of us.

Heard about 65bet1 from a friend. Signed up and had a quick look. The interface is nice and clean, and easy to use, still exploring. Check them out: 65bet1

Hello.This post was really motivating, especially since I was browsing for thoughts on this topic last Thursday.

I do agree with all the ideas you’ve presented in your post. They are really convincing and will certainly work. Still, the posts are very short for beginners. Could you please extend them a bit from next time? Thanks for the post.

I tried lucky57gamedownload site for quick downloads. I downloaded a game and everything went smoothly! Here’s direct access: lucky57gamedownload

Hi there, its fastidious piece of writing concerning media print, we all be aware of media is a impressive source of facts.

Call-girls Brasilia

OKWingameBet, nothing crazy honestly. Easy to jump on after work. If you’re looking for the page, take a look here lads: okwingamebet

I’d need to examine with you here. Which isn’t one thing I normally do! I get pleasure from studying a submit that will make folks think. Additionally, thanks for allowing me to remark!

Hey, I’ve been spinning the reels at Slotspalace10 lately and, I gotta say, it’s pretty decent! The game selection is solid and I even snagged a little win last week. Definitely worth checking out if you’re looking to try your luck. Check them out here slotspalace10.

Thank you a bunch for sharing this with all of us you really realize what you’re speaking about! Bookmarked. Kindly additionally visit my site =). We could have a hyperlink change contract among us!

Just desire to say your article is as astounding. The clearness in your post is simply great and i could assume you’re an expert on this subject. Fine with your permission allow me to grab your RSS feed to keep up to date with forthcoming post. Thanks a million and please carry on the enjoyable work.

https://malhamad.net/44388/

This excellent website truly has all the information and facts I wanted concerning this subject and didn’t know who to ask.

лучшее казино с быстрым кешаутом

https://t.me/s/kaZiNo_S_MiNiMaLNYM_dEPozItom/4

https://1wins34-tos.top

https://t.me/s/minimalnii_deposit/124

https://t.me/s/KAZINO_S_MINIMALNYM_DEPOZITOM

Hi there! Do you use Twitter? I’d like to follow you if that would be okay. I’m absolutely enjoying your blog and look forward to new posts.

https://jn.com.ua/remont-far-avto-yak-usunuty-trishchyny.html

WOW just what I was searching for. Came here by searching for %meta_keyword%

igrice za decu kosarka

Great line up. We will be linking to this great article on our site. Keep up the good writing.

https://t.me/s/russia_caSino_1WIN

Great remarkable issues here. I am very glad to peer your article. Thanks a lot and i’m looking ahead to touch you. Will you kindly drop me a mail?

You got a very fantastic website, Sword lily I noticed it through yahoo.