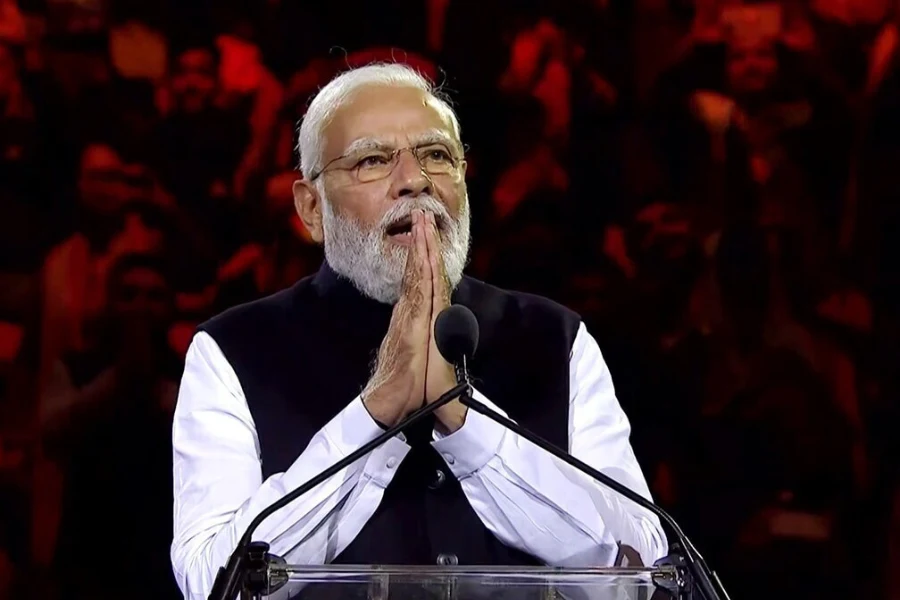

Narendra Modi 75th Birthday: 11-Year Market Journey

thenewsbuzz September 17, 2025 1

As of today, September 17, 2025, India’s Prime Minister Narendra Modi is celebrating his 75th birthday. To mark the occasion, the Indian stock market is now recognized as one of the best competitors in the world. With the Sensex and Nifty both having grown almost four times the value since 2014 when Modi took office.

In 11 years, the financial markets have made notable gains, fueled by policy decisions, capital infusion and growing retail participation.

Market Performance Since 2014

When Modi was sworn into office in May of 2014, the Nifty index was at approximately 7,360 points. As of September 2025, it has risen past the 25,100 mark – a spectacular 240% growth. The BSE Sensex rose from 24,690 to above 82,000 for an almost 235% gain as well.

This dramatic ascent places India alongside the U.S. S&P 500, which gained 245% during the same period, while conceivably surpassing only the Dow Jones, which gained just 175%.

But, the larger narrative is perhaps beyond large cap indices.

Small Cap and Mid-Cap Boom

The BSE 500 index gained almost 288% during Modi’s reign while the small- and mid-cap stocks truly led the way.

- BSE Midcap Index: +435%

- BSE Smallcap Index: +491%

It appears wealth creation did not strictly occur within large corporations but almost dispersed further benefits to a larger marketplace.

India is much more advanced than emerging markets. The MSCI EM index increased just 27% across the 11 years.

Reasons for Market Growth

India’s stock market rallied most significantly during Modi’s prime ministership, which was entwined with many different reasons:

Economic reforms – such as the Goods and Services Tax (GST) and the Insolvency and Bankruptcy Code (IBC); public sector bank recapitalization; and Direct Benefit Transfers.

Private sector investment – there was a significant increase in capital expenditures with ₹11.11 lakh crores (3.4% of GDP) budgeted for infrastructure in FY26.

Retail investors – the number of investors has increased dramatically, growing from 4.9 crore in FY20 to 13.2 crore by the end of December 2024, driven by a reliance on digital platforms and demand for savings post-pandemic.

Sectoral growth – the infrastructure, automotive, information technology, and energy sectors performed extraordinarily well because of government policies promoting ‘Make in India’ and self-sufficiency.

Sector Performance

- Nifty Bank: Up 259% as the private banks worked on their balance sheets.

- PSU Banks: Up 80%, as change was slower because of reforms not being implemented.

- Nifty Energy: Up 244% because of capital expenditures and self-sufficiency.

- Nifty CPSE: Up 147%.

- Nifty Auto: Up 316%, spurred by reduced GST and increased consumption.

- Nifty IT: Up 300%, illustrating India’s domination in the global technology market.

These industry patterns highlight how a rapid succession of policy interventions facilitated significant equity market growth.

Stock Market Perspective: Sensex at 1,00,000?

As Modi enters his 12th year of rule, there’s been some discussion around whether the Sensex can get to 1,00,000 during the current ruling party’s terminology.

In reviewing the data, it has been stated that with corporate earnings expected to grow 10–12% CAGR in FY26-27, stable oil prices, and positive interest rate momentum globally, it is possible to reach 1,00,000 Sensex, likely somewhere in 2029.

The downside risk remains in a global recession, oil price fluctuations, or a poor valuation of cyclicality.

On Narendra Modi’s 75th birthday, the story of India’s stock market in front of his rule is compelling in light of the change over the past 11 years. These contributions, structural reforms, investment in infrastructure, and a more engaged investor community all assisted in positioning India as one of the most robust equity booms globally.

For investors and corporates, the milestone is recognition of past success and provides a moment to preview the anticipated future. The latest news on Business about companies joins in bringing lively discussions about India’s economic outlook, and many are waiting to see if Sensex can reach the significant 1,00,000 level in the coming years.

ccblzk